The global financial marketplace presents a vast and dynamic landscape for savvy investors. Previously, participation in this market has often been restricted to large institutions and experienced traders. However, the emergence of innovative platforms and technologies is revolutionizing access, enabling individuals to leverage the power of collective capital. Through collaborative trading strategies and shared risk management, participants can amplify their potential for success in this dynamic arena. This paradigm shift is opening up unprecedented avenues for individuals to navigate in the global forex landscape.

Embarking on the Forex Market with a Shared Capital Strategy

websiteVenturing into the dynamic world of forex trading often necessitates a well-defined strategy. One approach gaining traction is the shared capital strategy, where multiple participants pool their resources to execute trades collaboratively. This methodology can offer several advantages, such as increased capital for larger trade sizes and the ability to diversify across a wider range of currency pairs.

- Nevertheless, it is crucial to establish clear guidelines and procedures for managing shared capital, including profit/loss allocation arrangements and decision-making systems.

- Thorough due diligence is also essential to identify compatible trading partners who align similar risk appetites and market views.

- Ultimately, success in forex trading with a shared capital strategy hinges on harmonious collaboration, clear communication, and a commitment to shared goals.

Global Capital Convergence in the Forex Arena

The contemporary financial/global/international landscape witnesses an unprecedented convergence/integration/fusion of capital markets. This phenomenon/dynamic/trend is reshaping the forex arena, presenting/offering/creating lucrative opportunities for savvy investors and businesses.

Fluctuations/Volatility/Shifts in currency values are driven by a multitude of factors, including economic indicators/interest rates/political developments. Understanding/Navigating/Analyzing these complex interrelationships/dynamics/factors is crucial for optimizing/maximizing/leveraging returns.

Global capital convergence has fostered/stimulated/accelerated liquidity/trading volume/market efficiency in the forex market. This increased participation/engagement/activity from institutional investors/retail traders/central banks contributes/influences/shapes the direction of currency pairs/markets/fluctuations.

The forex arena presents a unique platform for capital allocation/risk management/diversification, allowing investors to exploit/benefit from/capitalize on global economic disparities. With its 24/7 nature/high liquidity/constant dynamism, the forex market offers a compelling/an exciting/unparalleled investment proposition/avenue/opportunity.

To thrive/succeed/excel in this dynamic environment, investors need to adopt/implement/utilize a strategic/holistic/comprehensive approach. This involves/requires/demands meticulous market research, risk assessment/portfolio management/trading discipline, and a commitment to/an understanding of/continuous learning about the ever-evolving global financial landscape.

Forex Capital Pool : Optimizing Returns through Diversification and Collaboration

In the dynamic world of forex trading, maximizing returns requires a strategic approach. A Forex Capital Pool presents an intriguing solution by utilize the power of diversification and collaboration. By pooling resources from multiple investors, the pool can secure a wider range of trading opportunities, effectively reducing risk. Each contributor's capital is strategically allocated across diverse currency pairs, creating a diversified portfolio that aims to amplify returns while minimizing potential losses. This collaborative model also allows for the sharing of expertise and market insights among pool members, leading to more informed trading decisions.

Furthermore, a well-structured Forex Capital Pool often utilizes advanced trading technologies and algorithms, significantly enhancing its ability to identify profitable opportunities and execute trades with precision. This combination of diversification, collaboration, and technological prowess positions Forex Capital Pools as a compelling avenue for investors seeking to maximize their forex trading outcomes.

Harnessing the Strength of a Global Forex Capital Network

In the dynamic ever-evolving landscape of global finance, exploiting the tremendous strength of an forex capital network has become essential. Individuals can capitalize on the massive liquidity and possibilities that exist within this worldwide system. By accessing on an global network, participants can optimize their trading approaches and secure enhanced success in the competitive forex market.

- Building strategic partnerships with leading financial institutions

- Facilitating access to a extensive range of trading options

- Implementing advanced technologies for streamlined execution and risk

The Future of Forex Trading: Leveraging Shared Resources for Profitability

The forex market continues to become increasingly challenging, necessitating traders to adopt innovative tactics to attain profitability. A key trend in the industry is the emergence of shared resources, which facilitate traders to network and harness collective knowledge for enhanced success.

Websites dedicated to forex trading are proliferating, providing a wide array of resources such as real-time market data, educational courses, and forums for interaction.

By participating in these shared resources, traders can acquire invaluable knowledge from seasoned professionals, remain current on market movements, and identify lucrative trading opportunities.

This network effect has the potential to revolutionize the forex trading landscape, democratizing access to profitable strategies and promoting a new era of shared success.

Devin Ratray Then & Now!

Devin Ratray Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Danny Pintauro Then & Now!

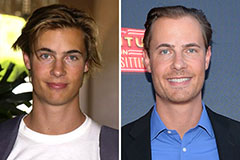

Danny Pintauro Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!